10 Steps Towards Smart Roof Financing

christine • August 17, 2020

If you do need a new roof and roof financing to make that happen, we strongly suggest you follow the steps below in an effort to spend as little as you can on a great addition to your home.

Ask Us About Financing

YOUR ROOFING COMPANY SHOULD OFFER FINANCING - BUT BEFORE YOU CALL ONE...

1. Assess Your Situation

Before you start calling roofers and getting estimates, it's important to calibrate your expectations and assess your needs. The three primary factors that determine the cost of a new roof are the size and complexity of your existing roof, your geographic location, and the material you choose for your new roof. If you have a large home, live far from a metropolitan area, or want a Spanish-style roof, you can expect to pay more, although local companies can often find cost-effective solutions in a wide variety of circumstances.

Additionally, you may be replacing your roof for a specific purpose, in which case you should make sure you know exactly how to relate your problem to a potential roofer and ensure that problem is resolved.

2. Shop Around

As you may have assumed, it is best to get more than one or two estimates before you make a decision about which roofer to hire. Fortunately, most roofers, such as Austin Roofing and Construction, will be happy to come out to your home and provide an estimate for free. Therefore, you should have no problem getting a few different perspectives on what exactly your roof will require.

3. Check In With Your Insurance Company

4. Put Aside As Much Cash as You Can

Once you have a realistic view of your needs, a few estimates in mind, and any possible contribution from your insurance company forthcoming, you can conduct a more thorough assessment of your own finances. As a general rule, you should try to pay in cash if that is possible for you. This practice saves you a lot of money in interest in the long-term, even though paying upfront can pinch your finances for a few months.

Even if you can't pay for your roof out-of-pocket, you should try to put as much down as you can in advance. In tandem with smart roof financing options, a large down-payment will leave you exposed to as little additional expense as is possible.

5. Working With a Trusted Roofer

If you are struggling to find a lender willing to finance your new roof, don't worry. You can always just ask whichever roofing company you end up employing. Roofing companies often have pre-existing relationships with lenders familiar with that company's operation. Your roofer may be able to suggest lenders they have worked with before. Often, the roofing company will handle the administrative burden of financing if you work with them.

6. Bundle the Services You Finance

Many companies that roof houses also provide other construction services. If you have to finance your roof anyway, it may be wise to have the same company remodel or repair whatever else is ailing your house. By having the same company perform all the relevant tasks around your home, you can cover all the larger expenses through one loan, often acquired through the company performing the services.

Including all necessary construction in one loan decreases the amount you will ultimately owe in two different ways. First of all, your principle will likely decrease. If you do a roof, a kitchen remodel, and a new bathroom, the company may take a little of the sticker price. Furthermore, if one loan covers everything, you are not subject to the additional administrative fees associated with multiple loans.

7. Home Equity Loans & Refinancing Options

Leveraging the equity you hold in your home for the sake of improving that home, and thereby increasing the resale value, is a great way to finance your new roof without causing a disruption in your short-term financing. The rates on home equity loans are extremely favorable and you can generally secure one with minimal hassle from the same bank you got your mortgage from.

Refinancing is slightly different than taking a home equity loan, but both strategies use the amount you have already invested in your home to improve your home. When you refinance, you essentially replace your old mortgage with a new one while pocketing the money you have accrued by paying against the principle of your loan with your monthly mortgage payments.

8. Personal Loans

Personal loans are often a strong roof financing option for new homeowners or those with little equity in their current home for other, ancillary reasons. If your credit is good and you can easily substantiate regular income on a loan application, personal loans shouldn't be too hard to find. As you would with potential roofers, shop around a bit and find a deal. Credit unions are particularly good at finding great rates on personal loans for their members.

The reason we put personal loans beneath home equity loans on our list is based strictly on interest rates. Because a home equity loan is secured by your home, the interest rates are much lower as the bank has property to guarantee the value of the loan. On the other hand, most personal loans are granted as unsecured debt, there is no collateral, so the bank charges more in interest to protect against default.

9. FHA Title 1 Loans

At this juncture, many homeowners with financial constraints who don't qualify for most loans begin to feel hopeless. It doesn't have to be so. In fact, the federal government seeks to empower low-income and financially constrained homeowners to improve their dwellings and ultimately increase property values in their neighborhood through the FHA Title 1 loan program.

To qualify for a home improvement loan through the Federal Housing Authority, you must either belong to a certain tax bracket or live in a predetermined portion of your metropolitan area or rural county. These loans offer borrowers very reasonable rates and minimal upfront costs. If you are in a tough spot, this is the best way to fund your new roof.

10. Credit Cards

You should only use a credit card to fund a roof if you have no other options. The interest rates on your credit card balance are simply atrocious: well above what a bank would charge you on a loan of any other variety. However, if you really have no other way to swing it, you can pay as much in cash as possible and have your roofer charge the rest to your credit card. Then, it's up to you to pay absolutely as much as you can scrounge up, especially in the first few months thereafter, to keep your credit limit in check and make sure your credit score doesn't plummet.

Conclusion

Ask Us About Financing

1. Assess Your Situation

Before you start calling roofers and getting estimates, it's important to calibrate your expectations and assess your needs. The three primary factors that determine the cost of a new roof are the size and complexity of your existing roof, your geographic location, and the material you choose for your new roof. If you have a large home, live far from a metropolitan area, or want a Spanish-style roof, you can expect to pay more, although local companies can often find cost-effective solutions in a wide variety of circumstances.

Additionally, you may be replacing your roof for a specific purpose, in which case you should make sure you know exactly how to relate your problem to a potential roofer and ensure that problem is resolved.

2. Shop Around

As you may have assumed, it is best to get more than one or two estimates before you make a decision about which roofer to hire. Fortunately, most roofers, such as Austin Roofing and Construction, will be happy to come out to your home and provide an estimate for free. Therefore, you should have no problem getting a few different perspectives on what exactly your roof will require.

You may be tempted to go with the lowest available estimate after a search through the roofers available in your area. This is rarely the best idea. Lower estimates are often an indication that the actual price will be higher: low-balling the cost of materials is a standard practice among contractors who want to bait customers into a commitment. Instead, prefer the potential roofer who is most transparent with you about potential roadblocks and costs. It will likely save you money.

Want a roof replacement estimate in under 2 minutes? CLICK HERE https://www.austinroofingandconstruction.com/roof-pricing

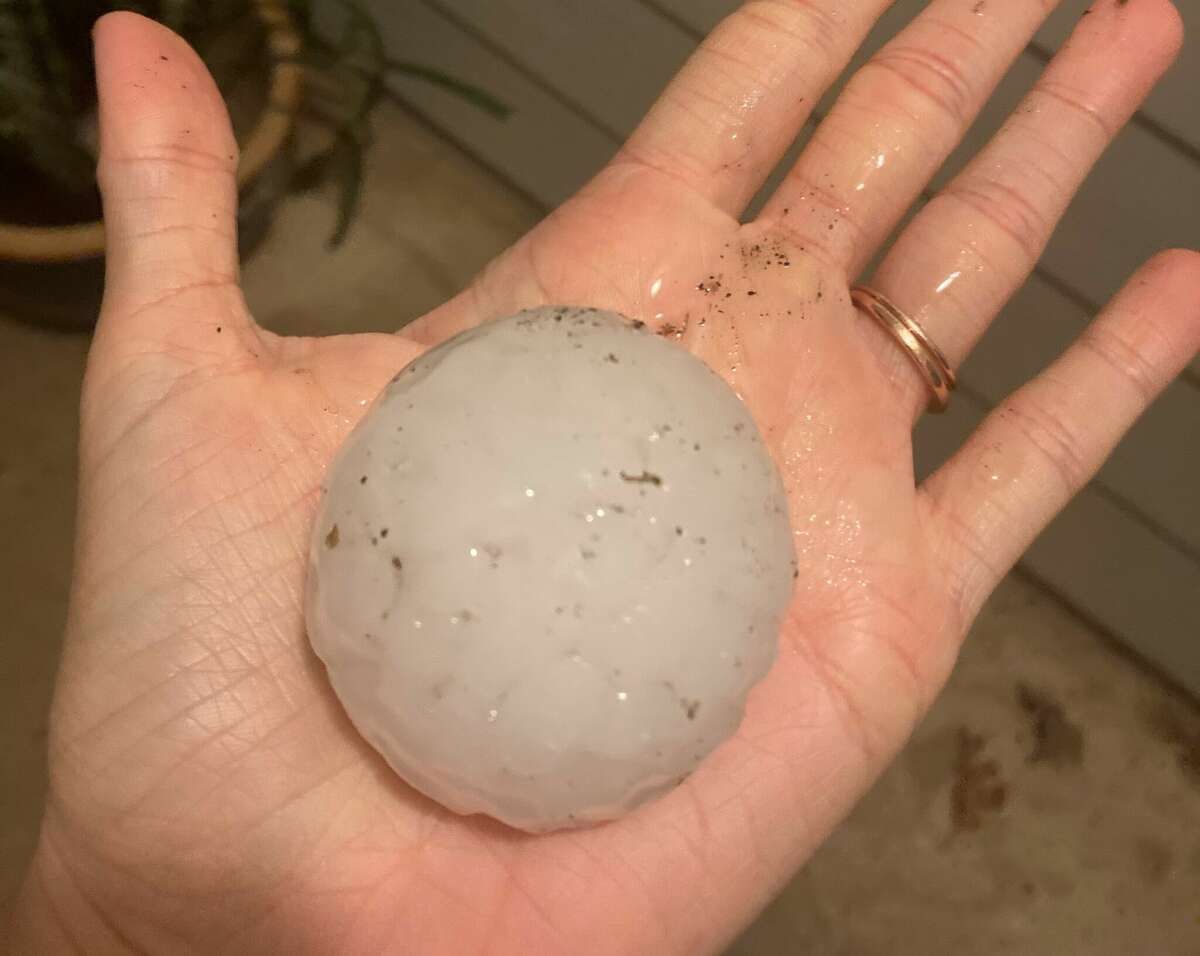

3. Check In With Your Insurance Company

Frankly, this step is a bit of long-shot, but, given the potential return, it is worth a phone call. Most homeowner's insurance plans will pay for a repair to your roof in the event of an unexpected leak that jeopardizes the value of your home, but not for a new roof altogether. For some, however, homeowner's insurance policies are a bit more helpful.

Some insurers, especially those who work in areas particularly vulnerable to storms with high-winds, may see value in subsidizing your roof as it ultimately protects their own investment in the durability of your home. At the very least, you should check. Even if you don't get a direct contribution from your insurance company, you may still benefit from a new roof. Many insurers will lower your monthly premiums when they know your home is safe beneath a new, high-quality roof.

4. Put Aside As Much Cash as You Can

Once you have a realistic view of your needs, a few estimates in mind, and any possible contribution from your insurance company forthcoming, you can conduct a more thorough assessment of your own finances. As a general rule, you should try to pay in cash if that is possible for you. This practice saves you a lot of money in interest in the long-term, even though paying upfront can pinch your finances for a few months.

Even if you can't pay for your roof out-of-pocket, you should try to put as much down as you can in advance. In tandem with smart roof financing options, a large down-payment will leave you exposed to as little additional expense as is possible.

5. Working With a Trusted Roofer

If you are struggling to find a lender willing to finance your new roof, don't worry. You can always just ask whichever roofing company you end up employing. Roofing companies often have pre-existing relationships with lenders familiar with that company's operation. Your roofer may be able to suggest lenders they have worked with before. Often, the roofing company will handle the administrative burden of financing if you work with them.

6. Bundle the Services You Finance

Many companies that roof houses also provide other construction services. If you have to finance your roof anyway, it may be wise to have the same company remodel or repair whatever else is ailing your house. By having the same company perform all the relevant tasks around your home, you can cover all the larger expenses through one loan, often acquired through the company performing the services.

Including all necessary construction in one loan decreases the amount you will ultimately owe in two different ways. First of all, your principle will likely decrease. If you do a roof, a kitchen remodel, and a new bathroom, the company may take a little of the sticker price. Furthermore, if one loan covers everything, you are not subject to the additional administrative fees associated with multiple loans.

7. Home Equity Loans & Refinancing Options

Leveraging the equity you hold in your home for the sake of improving that home, and thereby increasing the resale value, is a great way to finance your new roof without causing a disruption in your short-term financing. The rates on home equity loans are extremely favorable and you can generally secure one with minimal hassle from the same bank you got your mortgage from.

Refinancing is slightly different than taking a home equity loan, but both strategies use the amount you have already invested in your home to improve your home. When you refinance, you essentially replace your old mortgage with a new one while pocketing the money you have accrued by paying against the principle of your loan with your monthly mortgage payments.

8. Personal Loans

Personal loans are often a strong roof financing option for new homeowners or those with little equity in their current home for other, ancillary reasons. If your credit is good and you can easily substantiate regular income on a loan application, personal loans shouldn't be too hard to find. As you would with potential roofers, shop around a bit and find a deal. Credit unions are particularly good at finding great rates on personal loans for their members.

The reason we put personal loans beneath home equity loans on our list is based strictly on interest rates. Because a home equity loan is secured by your home, the interest rates are much lower as the bank has property to guarantee the value of the loan. On the other hand, most personal loans are granted as unsecured debt, there is no collateral, so the bank charges more in interest to protect against default.

9. FHA Title 1 Loans

At this juncture, many homeowners with financial constraints who don't qualify for most loans begin to feel hopeless. It doesn't have to be so. In fact, the federal government seeks to empower low-income and financially constrained homeowners to improve their dwellings and ultimately increase property values in their neighborhood through the FHA Title 1 loan program.

To qualify for a home improvement loan through the Federal Housing Authority, you must either belong to a certain tax bracket or live in a predetermined portion of your metropolitan area or rural county. These loans offer borrowers very reasonable rates and minimal upfront costs. If you are in a tough spot, this is the best way to fund your new roof.

10. Credit Cards

You should only use a credit card to fund a roof if you have no other options. The interest rates on your credit card balance are simply atrocious: well above what a bank would charge you on a loan of any other variety. However, if you really have no other way to swing it, you can pay as much in cash as possible and have your roofer charge the rest to your credit card. Then, it's up to you to pay absolutely as much as you can scrounge up, especially in the first few months thereafter, to keep your credit limit in check and make sure your credit score doesn't plummet.

Conclusion

Call Austin Roofing and Construction today 512-629-4949. We provide helpful suggestions and can find a way to work with whatever financing option works best for you. Our loans are for 2 to 15 years with low monthly payments. No pre-payment penalties!

We can typically get everyone approved, so give us a call even if you think you're not eligible. You deserve a good roof over your head!

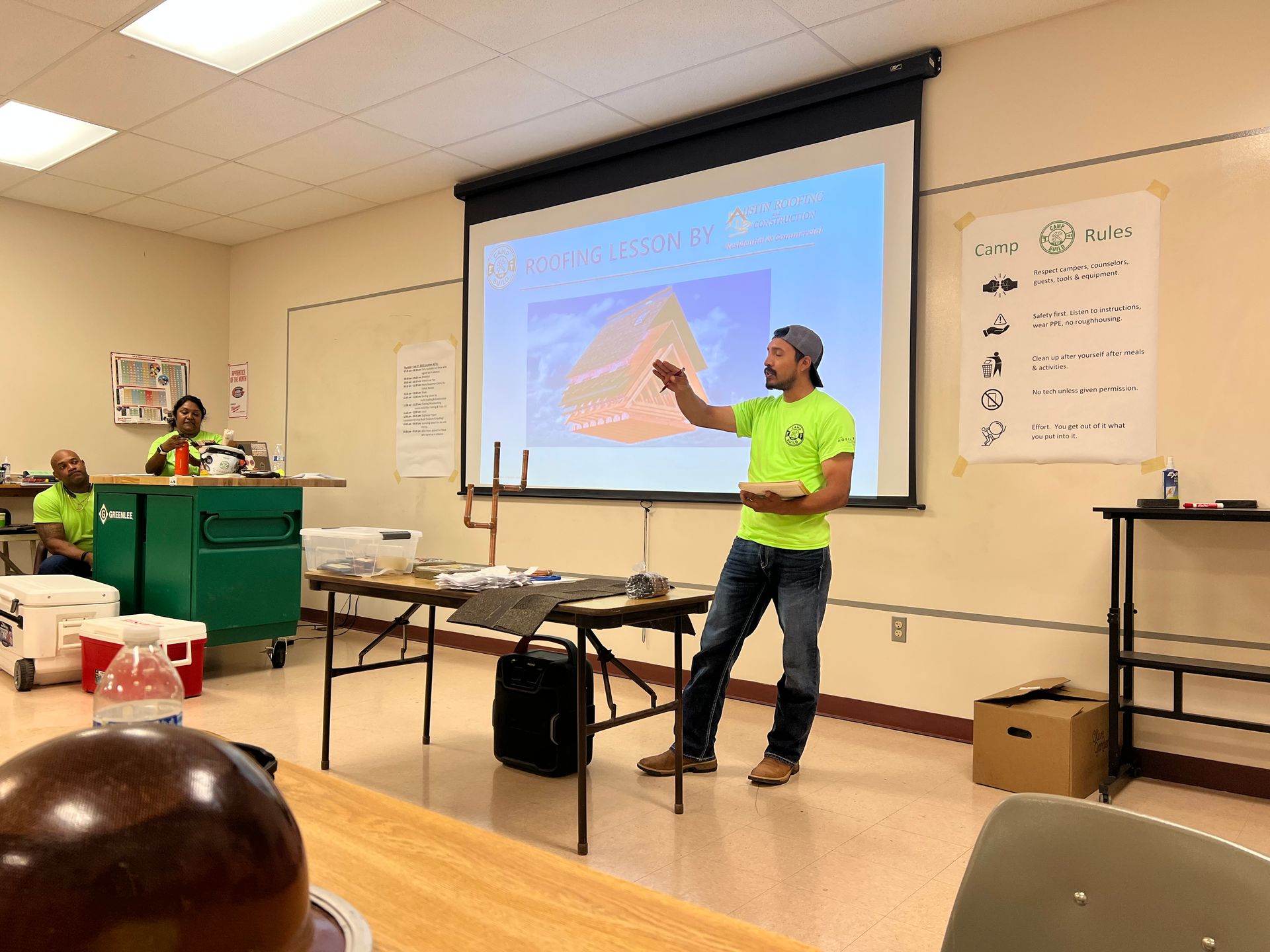

Together we built home #23 for a wonderful family in Wimberley, TX.

GAF & Austin Roofing and Construction donated the roof portion of home. We see our friends and neighbors in these photos. We are grateful for the opportunity to participate. Thank you Habitat!

http://wimberleyhabitat.org/gallery

https://www.austinroofingandconstruction.com/r-a-w

GAF Energy, a Standard Industries company and a leading provider of solar roofing in North America, has opened it's new 450,000 square foot manufacturing facility in Georgetown, Texas, to meet growing demand for the award-winning Timberline Solar™ roof. The new facility, the company’s second, will increase its capacity by 500% and bring total production of its solar shingle to 300 megawatts annually, making GAF Energy the largest producer of solar roofing in the world. In 2021 Timberline Solar™ features the world’s first nailable solar shingle and is the only roof system to directly integrate solar technology into traditional roofing processes and materials.

Leaking Roof Repair Cost - The cost of repairing a leaky roof can vary depending on a number of factors, including the size and severity of the leak, the type of roofing material, the location of the leak, and the cost of labor in your area. According to HomeServe USA, the average cost of repairing a leaky roof is $1,195. However, the typical price range is $390 to $2,000. The extreme low-end cost is $150, and the extreme high-end cost is $8,446.

10 Reasons to Get a New Roof With Austin Roofing & Construction

You need honesty, integrity, knowledge & a damn good warranty! We have it all and we do it for you! 1: We Know Our Roofs. 2: We Think Customer Service First. 3: Safety is the Name of the Game. 4: We Can Do It All. 5: We Offer Great Warranties. 6: We Care About the Community. 7: We Offer Free Estimates. 8: We're Certified on the Best Roofing Materials. 9: We're Absolutely Thorough. 10: Did We Say That We Are Local? :)